what is maryland earned income credit

Credit is actually money back on your tax bill. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

Earned Income Tax Credit Who Qualifies Changes For 2022

Calculate your federal EITC.

. See Marylands EITC information page. The local EITC reduces the amount of county tax you owe. Election to use prior-year earned income You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income.

The earned income tax credit EITC is a refundable tax credit designed to provide relief for low-to-moderate-income working people. Part-year residents and nonresidents must prorate the earned income credit in accordance with our instructions. If you earn less than 57000 per year you can get free help preparing your Maryland income tax return through the CASH Campaign.

Earned income includes all the taxable income and wages you get from working for someone else yourself or from a business or farm you own. Senate Bill 218 extends the tax credit to people who pay taxes using Individual Taxpayer Identification Numbers ITINs for the 2020 2021 and 2022 tax years. Some taxpayers may even qualify for a.

3618 if you have one child. It helps reduce the amount owed on taxes and can even result in a refund. Log Out If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. It is different from a tax deduction which reduces the amount of income that your tax is calculated on. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The Earned Income Tax Credit also known as EITC or EIC is a benefit designed to support low- to moderate-income working people. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to an earned income tax credit on the state return equal to 50 percent of the federal tax credit. 50 of federal EITC 1. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

By design it is meant to benefit working families more than workers without children who qualify for the EITC credit. March 9 2021. The Earned Income Tax Credit also called the EITC is a benefit for working people with low-to-moderate income.

You must file taxes to claim it. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

The earned income tax credit EITC is a refundable tax credit used to supplement the wages of low-income workers and help offset the effect of Social Security taxes. EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families. 28 of federal EITC.

For more information see Earned Income Tax Credit. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund. 5980 if you have two children.

It is the nations most effective anti-poverty program. In 2019 25 million taxpayers received about 63 billion in earned income credits. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC.

The maximum federal credit is 6728. In some cases the EIC can be greater than your total income tax bill providing an income tax refund to families that may have little or no income tax withheld from. This year the EITC is getting a second look from taxpayers because many have experienced income changes due to COVID-19.

Earned Income Tax Credit. Did you receive a letter from the IRS about the EITC. The credit is equal to 50 of the federal tax credit.

Click here to learn more about EITC and find the free tax preparation site closest to you. The Earned Income Tax Credit EITC was first enacted on a temporary basis in 1975 as a modest tax credit that provided financial assistance to low-income working families with children. Some taxpayers may even qualify for a refundable Maryland EITC.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. EITC Information in Spanish.

Does Maryland offer a state Earned Income Tax Credit. Eligibility and credit amount depends on your income family size and other factors. The maximum Earned Income Tax Credit amounts for the 2021 tax yearthe return youd file in 2022are as follows.

You may claim the EITC if your income is low- to moderate. 6728 if you have three or more qualifying children. Thestate EITCreducesthe amount of Maryland tax you owe.

Find out what to do. Earned Income Tax Credit EITC Rates. 1502 if you have no children.

Common EITC Questions and Answers. R allowed the bill to take effect without his signature.

Montgomery County Md 311 Answering To You

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

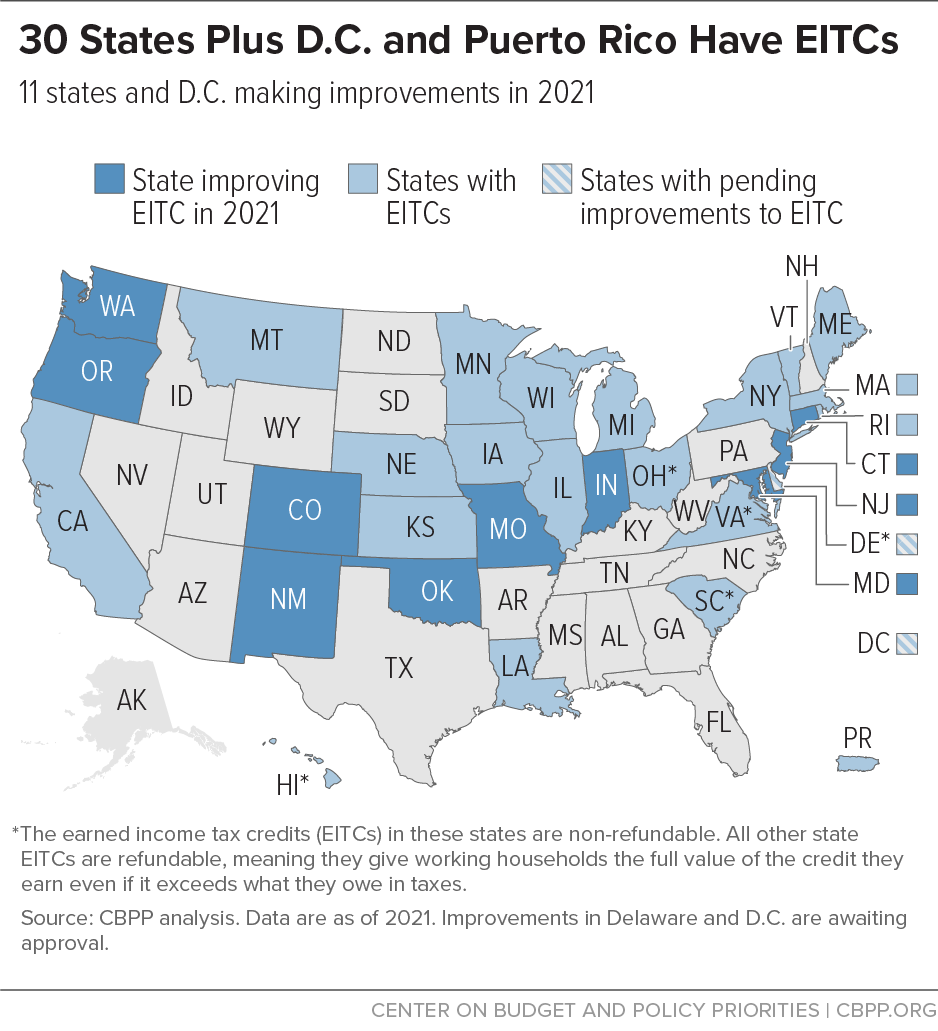

Record Number Of States Create Or Improve Eitcs To Respond To Covid 19 Center On Budget And Policy Priorities

Earned Income Tax Credit Now Available To Seniors Without Dependents

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Child Tax Credit Schedule 8812 H R Block

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Earned Income Credit H R Block

What S The Most I Would Have To Repay The Irs Kff

What Is The Earned Income Credit Check City

Earned Income Credit Tax Law Changes For Tax Year 2021 And Beyond Tax Pro Center Intuit

Eic Frequently Asked Questions Eic

.png)

What Is The Earned Income Credit Check City

Louisiana Update April 2021 All In One Poster Company

Equity Definition Accounting Cash Flow Statement Balance Sheet

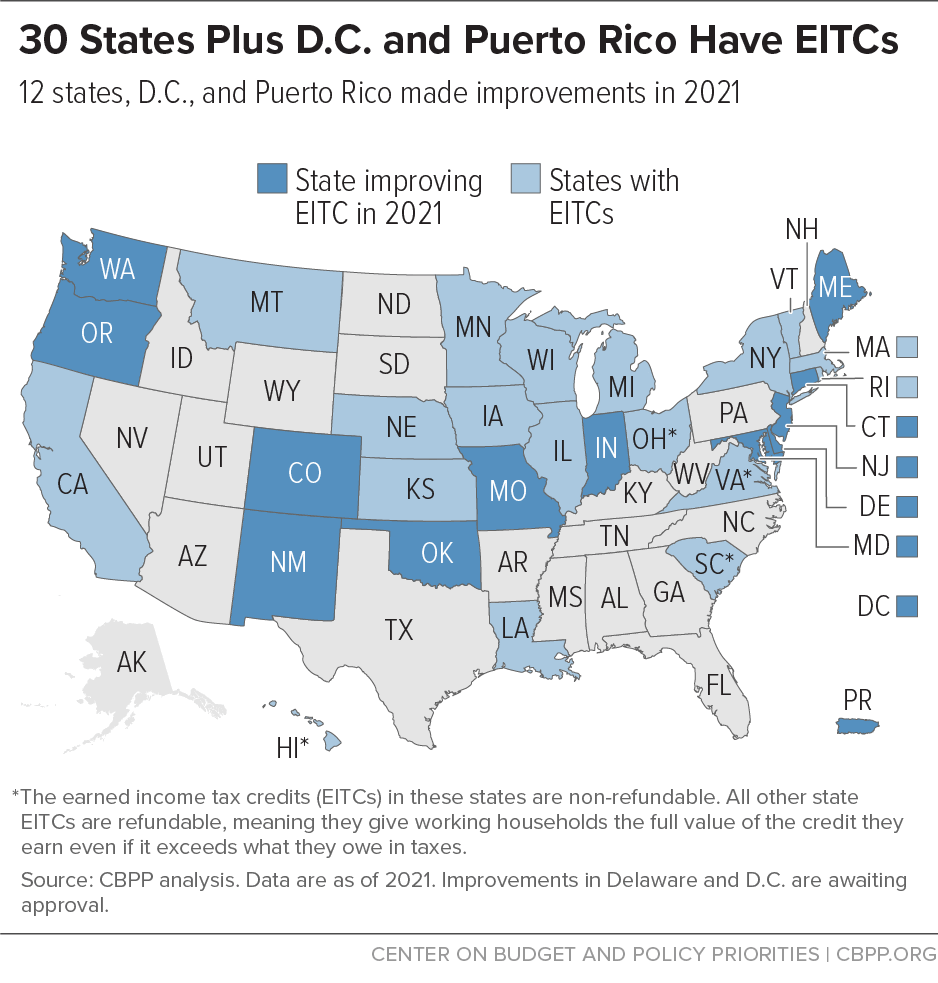

A Record 14 States Territories Created Or Improved Eitcs To Respond To Covid 19 Center On Budget And Policy Priorities

Summary Of Eitc Letters Notices H R Block

How Older Adults Can Benefit From The Earned Income Tax Credit